Crazy by Design

The healthcare enterprise is riddled with opportunities for playing intermediary. At its most basic, however, health care is simple: patient wants/needs care from a provider that can help them feel better. If you think about it like that, it is no different than the relationship between car owner and mechanic: car needs repair, mechanic fixes, car owner pays. Now, hold on. Supposedly, health care is simple, but there was no mention of who pays for it.

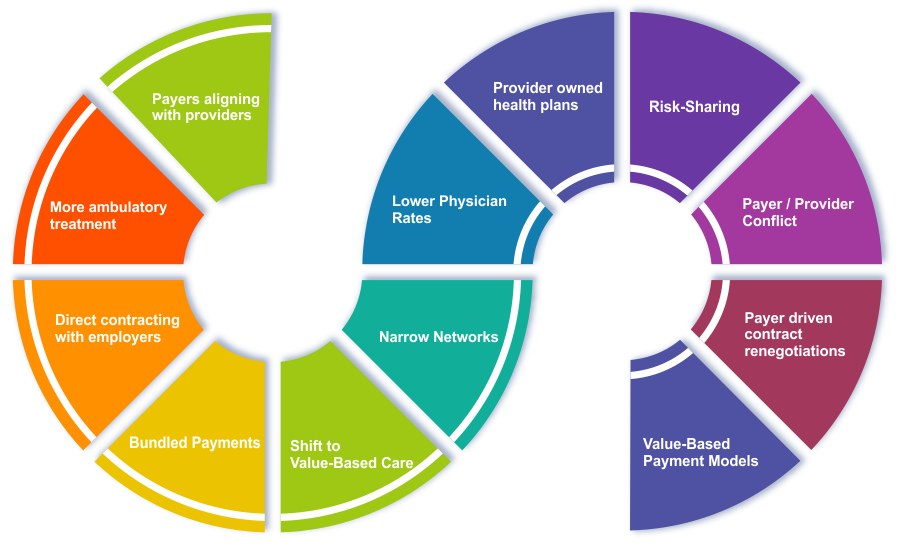

The reality of health care is much more complicated when it comes to how that payer-provider interaction comes into play for the patient. As reflected in the prevalence of macro trends – some examples of which are captured in the image.

Another basic understanding is that payer-provider convergence is all about "cutting out the middleman." This, however, is a complicated paradigm.

Hard Truths

We know the three basic ingredients are: patients, providers, and payers. From the providers’ perspective, the insurance carrier (a representative of the payer) is considered the middleman between the provider and the patient. Conversely, payers view the middleman as the provider systems (representatives of individual providers).

Payers see much of the existing provider side infrastructure as offering zero value to the provider in terms of the patients’ expectations - singularly helping them feel better.

Payers want to cut out the middlemen which they see as all the options that exist to keep physicians independent, such as management services organizations (MSOs), independent physician associations (IPAs), and physician hospital organizations (PHOs). Further expanding their position, many payers consider it wasteful to reimburse small practices for the services they provide. Payers feel they could just hire doctors themselves to see the members that they have and cut out all the existing middlemen. Within this there are many variations to accomplish that goal; however, it is, overall, the present situation we see with payer-provider convergence. So, let’s call this “Payer-Provider Convergence 1.0.”

In economic terms, Payer-Provider Convergence 1.0 is simple: the provider is on the supply side and employers (stay with me) are on the demand side. The provider is called only when the covered employee has a need. The goal is to eliminate everything in the middle (everything associated with the middlemen), however there is evidence this just opens the door for more middlemen.

The insurance company’s middlemen come in by way of product development: insurance plans and physician directories, sales (enrollment) and distribution (member welcoming), billing (premiums) and payments (to providers).

The provider side middlemen also do this through their own product development: rate negotiation (IPA or PHO) and billing (MSO or practice management company).

Now we need to ask ourselves, if we only cared about a direct patient-to-provider value chain, could these all be bundled together as representative of overly enterprising middlemen?

This is When Reality Hits

As a benchmark, we can go back to the car owner/mechanic relationship analogy to demonstrate an efficient value chain: demand side = car owner that pays money to the supply side = mechanic without any other waste in between.

Then, too, employers will be involved as payers for health insurance versus the patient in the health insurance realm. A semi-perfect health economy is when employers pay the provider directly and cut out all the middlemen (which we can now safely call waste).

This is the revelation that created Payer-Provider Convergence 1.0. In its ultimate form that puts insurance companies out of business. Payers want a direct connection to the patient. Since the payer is the ONLY institution that possesses the encounter data for a patient’s ENTIRE continuum of care: ambulatory, transport, DME, pharmacy, hospital, sub-acute, chiropractic, PT, ST, OT, behavioral, etc., they feel they are in the best position to deliver care. They just need the licensed hands to perform the care. Those are doctors and pharmacists, which they could employ directly.

This is a very strong argument as to how doctors perceive insurance companies as the enemy; the misers of money who only want to deny services and play doctor.

Enter Payer-Provider Convergence 2.0

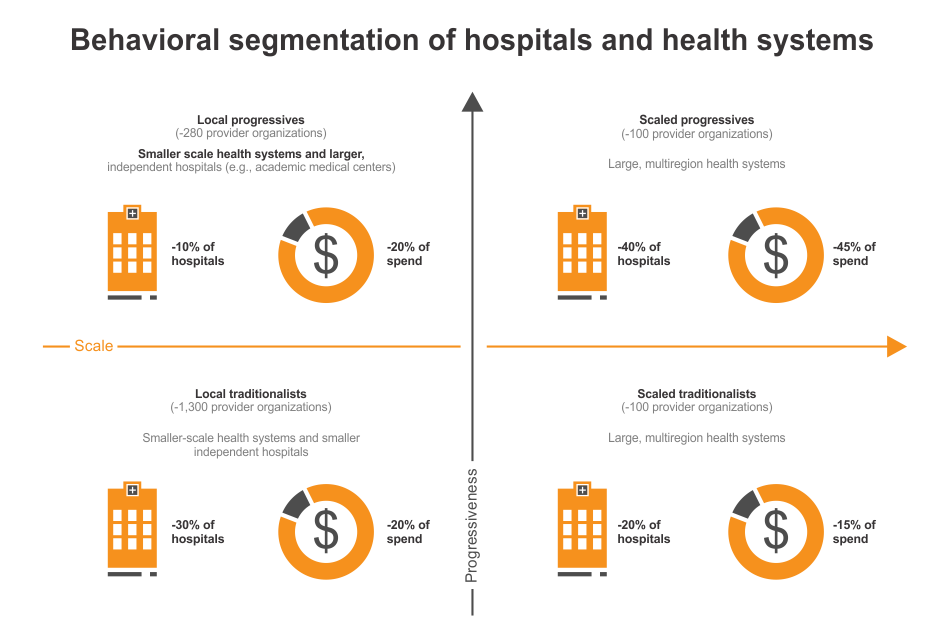

Payer-Provider Convergence 2.0 is a compromise strategy that innovates around the tension of providers’ eminence vs payer dominance. It is true that in Payer-Provider Convergence 2.0, expensive health systems might not have it as easy. Yet these big health systems that have the negotiation power to demand higher reimbursements can and should compete with high-quality care available at a low-cost community hospital.

The community hospitals are low-cost because they do not have the negotiation power to demand higher reimbursement rates. And this is exactly how Narrow Networks were created. Sometimes these are referred to now as Managed Care 2.0.

Narrow networks are an even smaller directory list of where a patient can seek care “in-network.” Essentially this is all for controlling referrals by physicians to expensive Big Brand health systems for services that could be performed at less costly sites of care, which is commonly referred to as “leakage.”

Optimizing the Win-Win

Now new, and better, questions arise: If, within even the narrow network, could a micro-network be established to control the network referrals? Could lower cost doctors at low-cost hospitals win and see new patients pushed to them? Could larger health systems still rule the land for the complicated care, but the value chain remains intact?

In this, payers could also win by paying out less for each procedure and keeping more profit. Then, in the perfect world, this comes back as a win for employers in the form of lower premiums. And patients win by paying less “out-of-pocket” expenses like co-pays and co-insurance.

So How Do We Make this Work?

The key to all this is to convince doctors to change their referral habits. With the right people, processes, and technology, micro-networks can thrive really well and the entire health care enterprise rises.

And that exact moment is right now.

Know Where You Can Turn for Help

Both payer and provider readiness checklists are critical to this process. These services and tools exist today and the methodology is proven. Vee Healthtek combines the best people, processes, and technology-enablement harnessed with the thought-leadership and industry expertise to architect client-specific solutions. A dedicated team will guide you through the right questions to ask and build a strategy with you that maximizes your current status. Regardless of whether you come from the payer-side or the provider-side, you can be confident you have chosen the right partner.