Author’s Corner

In her white paper, Silpa Saladi, Client Operations Director, discusses the dangers and consequences of fraud, waste, and abuse in healthcare billing. In particular, Silpa’s white paper identifies different types of fraud, waste, and abuse that can be remedied with data mining, analytics, and machine learning.

Please click on the video to the right to learn more about Silpa, her paper’s key takeaways, and her motivation for writing on this subject.

To discuss this white paper at length, please contact the author using her information provided at the bottom of the page.

In the United States, healthcare payers lose billions of dollars every year to insurance fraud, waste, and abuse (FWA). The Government Accountability Office (GAO) has designated Medicare as a high-risk program since 1990 because of its size, complexity, and susceptibility to improper payments.

Typical schemes include improper coding, overbilling, excessive/unnecessary services, and duplicate claims. Most payers and providers do not have the technology or sufficient human resources to evaluate and examine the vast number of submitted and received claims each day.

Fraud detection techniques are transitioning from antiquated investigative manual work to advanced analytics and data mining. Payers and providers are in search of innovative technology to more efficiently detect FWA.

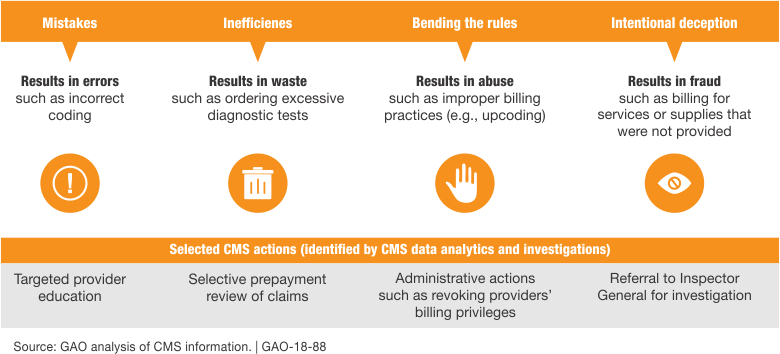

What is Fraud, Waste, and Abuse (FWA)?

- Fraud: Intentional deceit for gain, punishable by criminal and civil laws

- Waste: Overutilization or misuse of resources

- Abuse: Directly or indirectly causing unnecessary or inappropriate costs to healthcare

The National Health Care Anti-fraud Association (NHCAA) conservatively estimates that $68 billion annually of the nation’s healthcare spending ($2.26 trillion) is lost to healthcare fraud. Still, the realistic number may be closer to $200 billion (approximately 9%). There are millions of health insurance claims submitted each day that help make quality care more reasonably priced, a fraction of which are fraudulent. However, their impact is significant and costs payers and the government several billion.

The most common types of fraud are:

- Incorrect Coding: Submission of multiple procedure codes for a group of procedures customarily covered by a single CPT code is known as unbundling. Upcoding refers to the submission of a code that misrepresents the actual service for higher reimbursements.

- Medical Necessity: Performing medically unnecessary services, which could include labs, diagnostic services, and even surgeries

- Ghost Billing: Billing for services that were not rendered

- False Patient Billing: Patients working with providers to falsify information for profit

Targeting High Volume, Low Value

According to the WHO, most healthcare fraud is “high volume, low value.” Hospital compliance programs and administrative staff often miss process inefficiencies and workflow glitches. A robust compliance program is mandatory; however, even the most sophisticated systems have gaps.

Working with external resources, such as third-party companies, helps support these organizations to fill in these fissures by providing a fresh set of eyes.

Technology with a Solution

With the large volume of claims and limited resources, it is challenging for healthcare organizations and payers to detect fraudulent activity on their own. In this day and age of artificial intelligence, there are various ways to find subtle patterns indicating fraud. Most payers and providers do not have the technology or human resources required to gain a bird’s eye view of the vast quantity of claims they are receiving.

This makes it impossible to identify subtle patterns that indicate fraud, waste, and abuse. That’s where machine learning can act as the ultimate detective to find subtle relationships in seemingly unrelated occurrences. Using statistics, machine-learning algorithms work by analyzing massive amounts of data to find connections and patterns.

Another way to leverage technology is to detect and prevent healthcare fraud using predictive modeling. Mining data and pinpointing suspicious claims using rules, database searches, and text mining can be invaluable. These “high-risk” claims are flagged for review to ensure they are viable for submission.

Let Us Protect You

At Vee Healthtek, we understand that a one-size-fits-all approach isn’t ideal. We perform a deep-dive audit to fully understand how we can customize a solution for your organization by combining predictive modeling technology, advanced analytics, supervised/unsupervised hybrid data mining and machine learning in identifying and reporting the irregularities and potentially fraudulent transactions.

Utilizing an artificial intelligence technology has proven to be cost-effective and less burdensome on the entire organization. Our solutions can be customized to proactively monitor and identify new schemes as soon as they emerge. Having successfully delivered projects across multiple domains and industries, we are ready to build customized solutions in evaluating claims.

Beyond healthcare, Vee Healthtek is in a constant process of using AI and ML as part of our services in anti-fraud programs across several industries and allocating budget in constantly advancing AI and ML anti-fraud technology over the next two years. We invite you to contact our experts to discuss your product needs in detail and develop a precise and cost-effective service package.