Author’s Corner

In this white paper, Michael Carnahan, Assistant Vice President Client Services, explores the best possible strategies for approaching the next big event after coronavirus. Michael also addresses the current state of U.S. healthcare, with many operating margins continuing to fall.

Please click on the video to the right to learn more about the author, his paper’s key points, and his motivation for writing on this subject.

To discuss this white paper in more detail, please contact Michael using the information provided at the end of the article.

As the COVID-19 pandemic continued to wreak havoc worldwide, hospitals and health care systems were increasingly at risk for financial crisis as they faced organizational challenges.

The World Health Organization (WHO) said that COVID-19 might never go away. It also advised global economies to learn to live with the virus as any other endemic one, such as HIV. This poses an exponential threat that has increased the stress on the U.S. healthcare system. The pandemic has also raised questions about the ability of the U.S. healthcare system to remain financially solvent amid the unprecedented changes in billable services and care delivery.

To get a handle on the pandemic and the rising costs of the highly infectious disease, hospitals started closing outpatient departments and canceling or postponing elective procedures early on. Unfortunately, these changes, though needed to combat the growing pandemic, threatened the financial viability and organizational ability of hospitals.

Hospitals with preexisting financial challenges, such as nonprofits and rural healthcare, historically operate on thin margins. Those that heavily rely on revenue generated from outpatient and elective services have been in the red for months.

Even though the U.S. federal government passed a financial bailout for hospitals and an economic stimulus package to kick start the sluggish economy, healthcare systems must reorganize to navigate healthcare finance in a post-COVID-19 world.

The State of U.S. Healthcare

Many hospitals operate on limited resources and liquid assets, and they are not capable of absorbing large financial shocks even as they mobilize sufficient resources to combat and respond to a critical event.

Based on 2018 data, U.S. hospitals had a 2.0% median operating margin (revenue minus operating expenses, divided by revenue) and a 2.1 median-asset-to-liability ratio (a hospital’s ability to pay short-term debt obligations).

The median hospital had only 53.4 days cash on hand (the number of days that it could continue to pay for operating expenses) and 49.2 days in its net accounts receivable (how long payment is left outstanding before it's collected). Many hospitals were in worse situations than the median; those falling below the 25th percentile having only 4.4% operating margins with 7.6 days cash on hand.

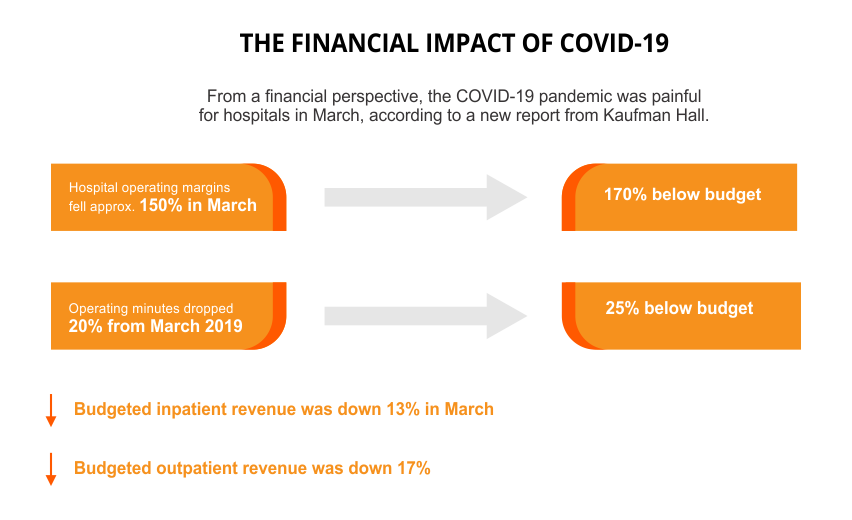

What's more, looking at hospital earnings before taxes, interest, amortization, and depreciation, operating margins fell over 100% in March 2020, which shaved a full 13% points from the previous year. Healthcare consulting firm Kaufman Hall stated that after the first full month of COVID-19 in the U.S., hospital operating margins were down by 282% compared to the same period last year and 326% below budget.

What the Experts Say

Many health system leaders and experts recommend shifting focus from liquidity concerns to look at issues related to hospital operations. Many in healthcare will face cost-cutting measures and will need to supplement their workforce.

Beyond the immediate financial concerns of the sector, healthcare leaders must contend with the organizational issues brought by the coronavirus outbreak. For instance, the industry needs to invest in information technology, physician satisfaction, and the lack of knowledge around telehealth and the billing and coding issues that go with it.

What Needs to be Done to Prepare for the Next Event?

1. Make Smart Human Capital Choices

Healthcare leaders must make smart human capital decisions to manage the immediate critical disruption of the workforce and leave room for rebuilding or sustaining themselves for the future. The key is to avoid the status quo and reshape a new, responsive workforce. Leaders must strongly consider how to find or educate staff that has the knowledge and expertise needed to survive in the new world. The industry will move to automation, such as RPA, where it can.

2. Revenue Restoration

Elective care is beginning to resume, but in especially hard-hit regions, volumes are still less than 50% of what they were. Organizations must plan by:

- Developing a plan to aggressively restore revenue by auditing previous claims, cleaning up AR, and ensuring all RCM functions are accurate and timely

- Building alternate clinical models like virtual scribe and telehealth to unlock new revenue sources

- Ensuring an aggressive supply chain management that will mitigate any risk of recovery delays, such as a lack of consistent supply of PPEs

Steps to take include:

Recapturing and restoring elective volumes that form the lifeblood of many health systems. Improving providers’ capacity as they address any access issues including expanded hours or a broadened use of telehealth services

Developing economic models that can sustain the adoption of digital care channels like telehealth, which have been instrumental in sustaining medical visits during the crisis

3. Cost Reduction

A smart approach moving forward will be the elimination of needless costs and finding broader operating-model changes to improve cost efficiency. Hospitals must also cut spending. This will be accomplished through technology, automation, and enlisting outside experts that can handle the volumes of patients returning to the system.

Why Should We Do It?

The main concern of any healthcare institution is achieving the best possible outcomes for patients. To achieve these goals, health care systems must be operationally sound, which means an unwavering focus on the revenue cycle along the patient-care continuum. If there is no money, there is no mission.

Why Look for Outside Help?

Health systems should increasingly look for opportunities to outsource administrative work, such as medical billing and coding. It will free up staff to focus on rebuilding key operations immediately following a critical event. As these systems look to reduce their operating costs, taking advantage of another company's economies of scale will become an even more welcome idea.

Healthcare organizations should also consider hiring service providers that already have the people, technology, and processes needed to achieve the best possible results. Organizations should look to technology-enabled, global business process solutions. They should look to organizations that have the acumen and track record of consistently delivering extraordinary outcomes to their clients.