The manual processes being used by health plans and provider groups lack sustainability, in an environment realizing a rapid expansion of value-based care payment models. Payer and provider C-suites are abandoning their conventional methodology of capturing as much beneficiary market share as possible for a more targeted approach that encompasses the extensiveness, contrast, and intricacies of a systematic value-centric partnership model between payers and providers.

what we know:

Legacy manual processes or application designs which facilitate a manual process will not scale to meet the market demands of capturing the true severity of illness in a fluid patient population. Each of us knows someone who is using spreadsheets or homegrown applications to manually reconcile data or balance to a tertiary system in hopes their "best guess" at the anticipated payment amount will get them through another contract year. This model may work in the short term, at least until providers come knocking in search of their bonus payments and/or incentives tied to their portion of the value-based revenues.

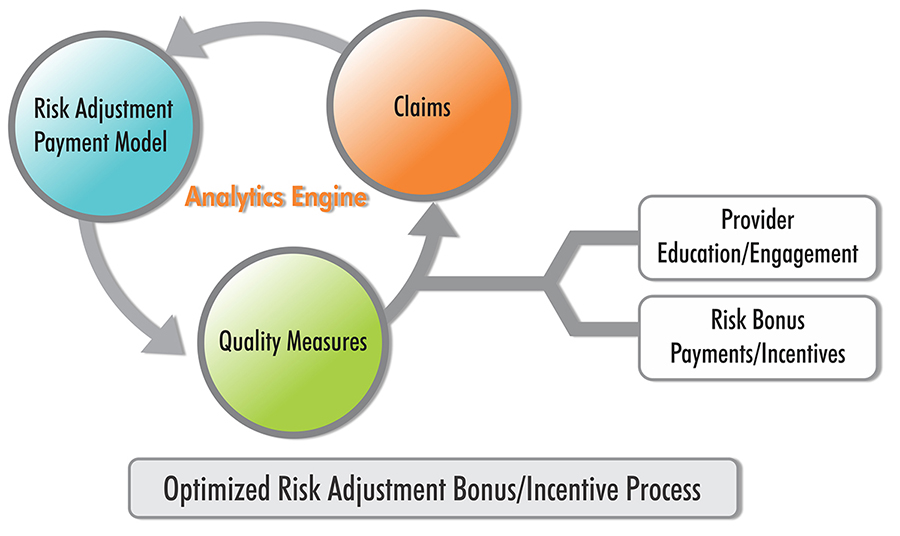

The gross majority of risk adjustment/value-based systems leverage claims data with performance reports (e.g., HEDIS, Retrospective HCC Reviews, CDI, CareGap reports) to create a baseline for provider performance, contract performance and revenue forecasting. However, none of these account for the fluctuating severity of illness of their patient population who, according to CMS, becomes miraculously (from a risk adjustment perspective) healthy every January 1st. During my initial interactions with clients, I cross reference the quintessential risk adjustment reporting and payment timeline against their current state model. In the overwhelming majority of engagements, CFOs are using retroactive data and retroactive legacy systems to reconcile current payments. This, of course, leads to systemic gaps, missed quality incentives payments, and physician burnout.

Success is contingent on the ability to act and react in real-time at the moment of provider-patient interaction. It also requires spending time educating your staff on the link between value-based payments and CDI/clinical quality measures. Collaboration with the payers to reconcile quality data and continuous physician clinical reviews will expedite linking an accurate and immediate payment amount. For example, inspiring a PCP to add ten preventative screenings a month would propel the physician into a new quality quartile, yielding a 10% to 20% bonus payment. This is still an emerging space which has yet to be mastered by any organization. Partnering with a robust vendor partner with the depth of experience on both the provider and plan side increases your odds of success. The hard truth is that the amount payer and provider CEOs spend on internal incentives rarely changes provider behavior. This is mainly because the time it takes to manifest a cash reward linked to the provider action can be upwards of 12 to 16 months.

Failure to invest or partner with a vendor experienced with risk adjustment within the next three years will set your organization back and lead to physician burnout and significant losses of value-based revenues. Vee Healthtek's Risk Consulting teams are here to help with risk process pain points, build up your internal capabilities to thrive in the risk adjustment space, and help you optimize the bonus payments for your organization.